On the evening of May 7, 2020, the Department of Health and Human Services (HHS) released the final rule for qualified health plans (QHPs) that operate on the health insurance Exchanges established by the Affordable Care Act (ACA), as well as several other types of plans operating off-exchange. Policies finalized in this rule address the use of copay coupons, notification of benefits covered by HRAs, and changes to special enrollment periods.

This final rule generally becomes effective on July 13, 2020, however policies with differing effective dates are noted below.

Qualified Health Plans Able to Exclude Manufacturer Coupons from OOP Spending Calculations Beginning in 2021; HHS Predicts “Minimal” Impact on Consumers

HHS is finalizing changes to existing policy with regards to manufacturer coupons. Starting next year, plans will be permitted, but not required, to not include any form of direct support offered by drug manufacturers to enrollees for specific prescription drugs toward the enrollee’s out-of-pocket (OOP) costs. This revision gives plans and issuers flexibility to determine to include or exclude coupon amounts from the annual limitation on cost sharing, regardless of whether a generic equivalent is available. Any state law concerning the use of coupons would supersede the policy (i.e. if a state has a law in place requiring health plans to count manufacturer coupons towards OOP expenses, that law would supersede the federal policy). The policy must be applied in a uniform, non-discriminatory manner.

For 2020, HHS granted plans the option of excluding cost-sharing assistance provided by drug manufacturers towards an enrollee’s maximum OOP costs, but only when a generic equivalent of the drug was available. In August 2019, the IRS issued a notice that high-deductible health plans (HDHPs) are required to disregard drug discounts and other manufacturer and provider discounts when determining if the deductible for a HDHP has been satisfied, and only allow amounts actually paid by the individual to be taken into account for that purpose. This notice creates a conflict in which a plan may be required to comply with both rules simultaneously.

In response to commenters raising concern that the proposal, if implemented by a health plan, would be counter to overall Administration efforts to lower OOP costs for patients, HHS noted that “no comments submitted by the health insurance industry on this [proposal]…expressed a desire to change their current practice.” Therefore, the agency believes “the impact to consumers will be minimal if issuers choose to continue their current behavior.” However, HHS encourages plans that do decide to change their policy to communicate the change to enrollees in a transparent manner. The agency also stated an intent to monitor the impact of the policy change.

This change will apply to all non-grandfathered individual and small group marketplace coverage, and all non-grandfathered large group and self-insured health plans.

Enrollees to be Provided Information on Benefits Covered by New HRAs

Excepted benefit health reimbursement arrangements (HRAs) sponsored by non-federal government entities will have to provide a notice to participants with information about the benefits available under the excepted benefit HRA. This information will include eligibility, annual or lifetime caps and other limits as well as a description or summary of the available benefits. This provision will come into effect for plan years beginning on or after January 9, 2021.

Both excepted benefit HRAs and individual coverage HRAs were authorized for plan years beginning January 1, 2020 and were intended to provide additional coverage options outside of the standard ACA-compliant health plans. Namely, funds from individual coverage HRAs may be used towards the costs of premiums for individual health insurance plans and excepted benefit HRA funds may be used to purchase excepted benefit coverage.

HHS Adopts Changes to Special Enrollment Periods (SEPs)

- Enrollees and their dependents who are in silver plans and become newly ineligible for cost-sharing reductions (CSRs) will be allowed to change their QHP one metal level higher or lower.

- This provision becomes effective January 2022.

- Exchange plans will be required to apply plan category limitations to dependents currently enrolled in Exchange coverage and whose non-dependent household member qualifies for a SEP to newly enroll in coverage. This would allow a qualified individual to add him or herself to a dependent’s current QHP.

- HHS is adopting this policy to align plan category limitations for exchange enrollees who are dependents and enrollees who are not dependents.

- Effective January 2022, HHS is shortening the time between the date of plan selection through certain SEPs and the effective date of the plan. Exchanges that use the federal platform will now be required to have a coverage effective date on the first of the month following plan selection.

- Previously, coverage only became effective the first day of the following month when a plan was selected between the 1st and 15th day of the month.

- Allow individuals and dependents provided qualified small employer health reimbursement arrangement on a non-calendar year basis to qualify for the existing SEP for individuals enrolled in any non-calendar year group health plan or individual health insurance coverage.

- Retroactive coverage termination for enrollees whose requests for coverage termination are not implemented due to technical error

HHS Seeks to Promote Value-based Insurance, Acknowledges Receipt of Public Comments

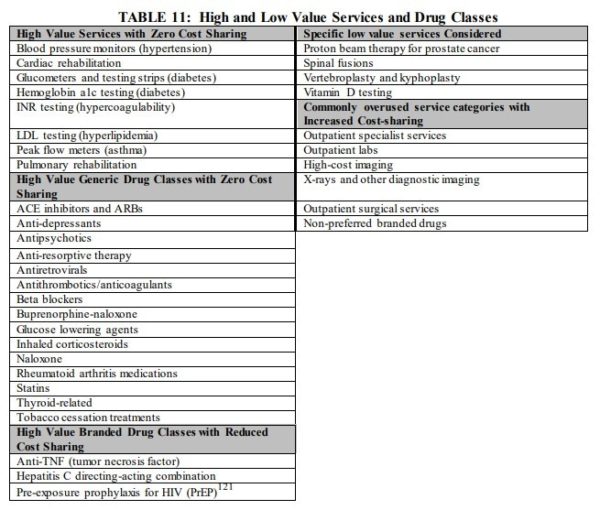

In the proposed rule, HHS said they were interested in promoting value-based insurance design in QHPs. The rule noted the existing flexibility that plan issuers have in designing cost-sharing structures but did not propose any changes to current HHS rules around this design flexibility. Instead, HHS included the below table of high and low value services for which the agency believes that cost sharing could be altered with minimal impact on premiums while incentivizing enrollees to seek appropriate care. Use of varying cost sharing is at the discretion of the plan issuer. The rule notes that this builds off of work done by the Center for Value-based Insurance Design at the University of Michigan.

HHS sought comments on the indication value-based plans on the exchanges and principles that could be adopted to establish what a value-based plan is. The agency acknowledges the receipt of various comments in response to this, saying they will continue to consider their options. Additionally, the agency notes it continues to look for ways to incorporate value-based design into stand-alone dental plans, however, no further details are provided.