On the evening of May 11, 2020, the Centers for Medicare & Medicaid Services (CMS) released the fiscal year (FY) 2021 proposed rule for inpatient hospitals and long-term care hospitals (LTCHs). The rule includes Medicare’s annual payment update as well as policies related to quality measurement, new technology add-on payments (NTAP), and CAR T-cell therapies. CMS notes that, in light of the ongoing COVD-19 public health emergency, the agency has decided to limit this year’s rulemaking to “essential” policies.

Comments on the proposed rule are due by 5 p.m. eastern time July 10, 2020.

CMS Predicts Overall Payments to Hospitals Will Increase by Over 2 Billion in FY 2021

CMS is estimating that that overall payments under Medicare’s inpatient prospective payment system (IPPS) will increase by approximately $2.07 billion in FY 2021, relative to payments made in FY 2020. This reflects the projected rate increase as well as changes to payments based on proposed changes to uncompensated care payments and new technology add-on payments.

CMS is estimating that the market basket increase will be 3.0 percent. This number is further adjusted by a multifactor productivity adjustment as well as whether a hospital submits quality data.

New Market-Based Data Collection to Drive Potential Future Change of MS-DRG Relative Weights

CMS proposes that hospitals will report certain market-based payment rate data on their Medicare cost report for reporting periods starting January 1, 2021. The data include:

- Median payer-specific negotiated charges that the hospital has negotiated with all of its Medicare Advantage (MA) organizations by MS- DRG; and

- Median payer-specific negotiated charges the hospital has negotiated with all of its third-party payers by MS-DRG.

CMS believes that as hospitals are already required to publicly report payer-specific negotiated charges based on policies adopted in the recent hospital price transparency rule. Therefore, it concludes that this additional effort of calculating and reporting median payer-specific negotiated charges will not be burdensome. CMS is seeking comment on a potential change to the methodology for calculating the MS-DRG relative weights to incorporate this market-based rate information beginning in FY 2024.

CMS Proposes New DRG for CAR T Therapies

After years of requests from stakeholders, CMS is proposing to create a new Medicare Severity Diagnosis-Related Group (MS-DRG) for chimeric antigen receptor (CAR) T-cell immunotherapy. These therapies will no longer be eligible for new-technology add-on payments in FY 2021 as they have been in the previous few years.

The ICD-10 procedure codes XW033C3 and XW043C3 are assigned to this new DRG, MS-DRG 018. CMS conducted a review of data from existing instances of utilization of CAR-T cell therapies to determine whether reimbursement under the currently-used DRG was adequate and noting a “vast discrepancy” in resource consumption, determined that a new MS-DRG code was warranted. The standardized charge per case for this MS-DRG is $913,224. The payment for this DRG would be adjusted for each individual hospital (as payment is for all DRGs) based on a variety of factors, including geography, medical education payments, and disproportionate share payments.

CMS notes that MedPAR data indicates that the average cost of CAR T-cell therapy cases that are part of a clinical trial are 15 percent of the average cost of cases not part of a clinical trial. Therefore, CAR T-cell therapy clinical trial cases will be adjusted so that payments appropriately reflect the needed resources.

CMS Proposes Using FY2017 S-10 Data for DSH Payments and Most Recent Available Single Year of Audited S-10 Data for Future Years

Based on the Medicare statute, hospitals can receive Medicare disproportionate share hospital (DSH) payments that are 25 percent of the amount they previously would have received under law (“the empirically justified amount”), and an additional payment for the DSH hospital’s proportion of uncompensated care (UC), determined as the product of three factors.

CMS projects that UC payments for FY2021 will decrease by approximately $534 million as compared to FY2020. CMS proposes to continue to use uninsured estimates produced by CMS’ Office of the Actuary (OACT) in the calculation of Factor 2.

Additionally, CMS proposes to use a single year of data on uncompensated care costs from Worksheet S–10 of the FY2017 cost reports be used to calculate Factor 3 in the FY2021 methodology for all eligible hospitals with the exception of Indian Health Service (IHS) and Tribal hospitals and Puerto Rico hospitals. Factor 3 would be calculated using the most recent available single year of audited Worksheet S-10 data.

CMS Proposes Earlier New Technology Add-on Payments for Certain Antimicrobial Products

CMS is proposing to update their policy for new technology add-on payments (NTAPs) for new antimicrobial products approved as a Qualified Infectious Disease Product (QIDP) or under the Limited Population Approval Pathway for Antibacterial and Antifungal Drugs (LPAD). Under the proposal, QIDPs and LPADs will be eligible for conditional NTAP payments the quarter after they receive FDA marketing authorization, instead of requiring manufacturers to wait through the annual NTAP application process.

Both QIDPs and LPADs would still be required to meet the cost criterion in order to be eligible for payments. Manufacturers would also be required to submit an application during the next NTAP application cycle.

Additionally, CMS is proposing to expand the policy enacted last year that deems QIDPs as meeting both the “new” and “significant clinical improvement” criterion to include products approved under the FDA LPAD program. CMS notes that currently there have been no drugs approved under the LPAD program.

Eight Applicants Use New Alternative Pathways for Consideration for New Technology Add-on Payments

The following manufacturers submitted applications for new technology add-on payments for the following devices and drugs, using the traditional approval pathway:

- Accelerate Pheno Test BC Kit (Accelerate Diagnostics)

- BioFIre FilmArray Pheumonia Panel (BioFire Diagnostics)

- ContaCT (Viz.ai)

- Supersaturated Oxygen (SSO2) Therapy (DownStream System) (TherOx, Inc.)

- Eluvia Drug-Eluting Vascular Stent System (Boston Scientific)

- GammaTile (GT Medical Technologies)

- Hemospray Endoscopic Hemostat (Cook Medical)

- IMFINZI (durvalumab) (AstraZeneca)

- KTE-X19 (Kite Pharma)[1]

- Lisocabtagene Maraleucal (Juno Therapeutics)

- SOLIRIS (eculizumab) (Alexion, Inc.)

- SpineJack System (Stryker, Inc.)

- TECENTRIQ (atezolizumab) (Genentech, Inc.)

- WavelinQ (4F) EndoAVF System (Becton Dickinson & Company)

- ZULRESSO (brexanalone) (Sage Therapeutics)

The following applicants used one of the new alternative pathways (for breakthrough devices and qualified infectious disease products). Because of that, CMS is proposing to approve all of the applicants for NTAP payments, beginning October 1, 2020:

- BAROSTIM NEO System (CVRx)

- NanoKnife System (Angiodynamics)

- Optimizer System (Impulse Dynamics)

- FETROJA (cefiderocol) (Shionogi & Co.)

- CONTEPO (fosfomycin for injection) (Nabriva Therapeutics)

- NUZYRA (omadacycline for injection) (Paratek Pharmaceuticals)

- RECARBRIO (imipenem/cilastatin/relebactam) (Merck)

- XENLETA (lefamulin) (Nabriva Therapeutics)

- ZERBAXA (ceftolozane and tazobactam) (Merck)

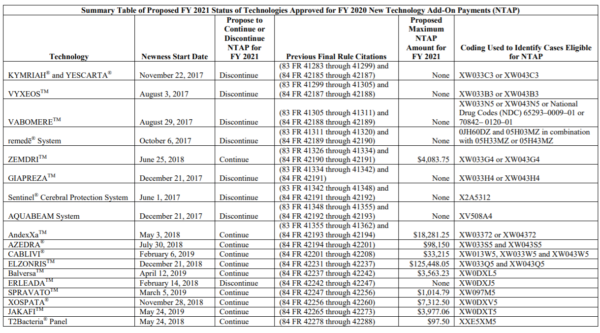

The list of continued and discontinued NTAP payment status for existing technologies is below.

CMS Proposes Automatic Adoption of Applicable Periods for Readmissions Reduction and Hospital-Acquired Condition Reduction Programs

To provide more certainty around future applicable periods for the Hospital Readmissions Reduction Reporting (HRRP) Program, CMS proposes to automatically adopt applicable periods for FY 2023 and all subsequent program years. The applicable period will be the 3-year period beginning 1 year in advance of the previous fiscal year’s start. For FY 2023, the applicable period will be the 3-year period from July 1, 2018 through June 30, 2021. This is advanced one year from the applicable period for FY 2022, which was established in the FY 2020 rule.

Under the Hospital-Acquired Condition (HAC) Reduction Program, hospitals ranking in the worst performing quartile receive a one-percent payment reduction on all the hospital’s discharges for the specified fiscal year. CMS also proposes to automatically adopt applicable periods beginning with FY 2023 program year for the HAC Reduction Program. The applicable period will be the 24-month period beginning 1 year advanced from the previous program year’s start of the applicable period. For FY 2023, this period would be the 24-month period from July 1, 2019 through June 30, 2021 since that is advanced one-year from the applicable period for FY 2022 (which was finalized in previous rulemaking). All subsequent program years would advance this 24-month period by one year. This applies for the CMS PSI 90 and CDC NHSN HAI measures.

CMS is not proposing any changes to the Hospital Value-based Purchasing Program.

For Hospital IQR Program, CMS Proposes Gradual Increase in Amount of Data Reported for eCQMs

For the Hospital Inpatient Quality Reporting (IQR) Program, CMS proposes to gradually increase the number of quarters for which hospitals are required to report electronic clinical quality measure (eCQM) data over a period of 3- years. The requirement will increase from one self-selected quarter of data to four quarters of data as follows:

- 2 quarters of data the CY 2021 reporting period/FY 2023 payment determination;

- 3 quarters of data for CY 2022 reporting period/FY 2024 payment determination; and

- 4 quarters beginning with CY 2023 reporting period/FY 2025 payment determination.

The number of eCQMs required will remain the same; only the amount of data will change. CMS is also proposing to begin public display of eCQM data with data reported for the CY 2021 reporting period. EHR technology certified to the 2015 edition will be required for all hybrid measures in the IQR program not just the Hybrid Hospital-Wide Readmission measure.

No new measures are being proposed for inclusion in the Hospital IQR Program measure set.

Promoting Interoperability Changes Would Mirror Proposals for Hospital IQR Program

CMS is proposing an EHR reporting period of a minimum of any continuous 90-day period for CY 2022 for new and returning participants of the Medicare Promoting Interoperability Program. For CY 2021, CMS is proposing that the Electronic Prescribing Objective’s Query of PDMP measures will remain optional and be worth five bonus points in CY 2021.

Consistent with the proposal for the Hospital IQR program, CMS is proposing to change eCQM reporting. Eligible hospitals would have to report two self-selected quarters of eCQM data from CY 2021, three quarters of data from CY 2022, and four quarters of data from CY 2023 and each subsequent year. Again, as is proposed for the IQR program, eCQM performance data from the Promoting Interoperability Program would be publicly available beginning with the CY 2021 reporting period on Hospital Compare or similar/successor websites.

CMS Proposes Changes in Definition of “Displaced Resident” for GME and IME

CMS proposes to redefine how residents are counted when a teaching hospital closes or terminates its residency program. This proposed change is designed to assist residents in finding an alternative program to complete their training. For the purposes of transferring funded GME/IME residency slots, a “displaced resident” will now be an individual who is at the hospital on the day before there is a public announcement of the closure rather than the day before the actual closure. There is no new funding or expansion of the current GME/IME program as a result of this proposal.

Long Term Care Hospital Payments Expected to Decrease in FY 2021

For FY 2021, CMS estimates that the LTCH PPS payments will decrease by $36 million in FY 2021. The Long-Term Care Hospital (LTCH) annual payment update for discharges using standard LTCH PPS is estimated to increase by 2.1 percent and, for LTCHs that fail to submit quality reporting data, the proposed payment update is 0.5 percent. The proposed rule affects 360 LTCHs nationwide, for discharges occurring on or after October 1, 2020.

CMS previously eliminated the 25- percent threshold policy in the FY 2019 LTCH PPS rule and established a transitional reduction to the one-time budget neutrality factor for estimated cost of elimination of the 25-percent threshold policy. For FY 2021, CMS proposes to apply a permanent one-time factor of 0.991249 for the estimated cost of the elimination of the 25-percent threshold policy.

Additionally, the statutory transition period for LTCHs receiving a blended payment rate for site neutral payment rate cases will end in FY 2021. Payments under the LTCH PPS will no longer be made in part based on the standard LTCH PPS for these discharges.

There are no proposed updates to the LTCH Quality Reporting Program.

Star Ratings Changes Pushed to Future Rulemaking

In the past year, CMS announced that the agency would be proposing changes to the hospital Star Rating methodology in FY 2021 IPPS rulemaking. However, since CMS has limited this year’s rulemaking to “essential” policies as a result of the COVID-19 pandemic, there are no proposals for the Star Ratings program included in this proposed rule. CMS states they will return to this topic in future rulemaking.

[1] This product is a CAR T-cell therapy. The other available CAR T-cell therapies, Kymriah and Yescarta, were eligible for NTAP payments for the previous fiscal years, but their NTAP status expires at the end of FY 2020. CMS has proposed a new DRG for these, MS-DRG 018, which has a proposed average case-weighted threshold amount of $1,237,393.