On July 29, 2019, the Centers for Medicare & Medicaid Services (CMS) released its 2020 End Stage Renal Disease/Durable Medical Equipment Payment proposed rule. In addition to changes to payments under the end-stage renal disease (ESRD) and durable medical equipment (DME) programs, the rule proposes changes to payment for renal dialysis, the ESRD quality incentive program, competitive bidding, and DME orders and prior authorization.

CMS anticipates that this proposed rule will increase overall payments to ESRD facilities by 1.6 percent, for an increase of $210 million in 2020. CMS is unable to estimate the impact of its changes to the DME rate setting and ordering methodologies.

Comments must be submitted to CMS no later than September 29, 2019.

ESRD Base Rate Raised by $5

Payment for ESRD services is made via a bundled prospective payment system adjusted for patient complexity. The base rate, which serves as the basis upon which other payments can be made, is adjusted annually to account for inflation. For 2020, CMS proposes to raise the ESRD base rate from $235.27 to $240.27, reflecting a 1.7 percent market adjustment and a 1.00418 percent budget-neutrality factor. The base payment for acute kidney injury (AKI) would be adjusted to the same rate. Because CMS did not reach its 2018 goal of 1 percent of ESRD payments qualifying for outlier payment, the rule proposes to lower the outlier thresholds.

New add-on payment for innovative dialysis equipment and supplies; changes for transitional drug add-on payments (TDAPA)

CMS is proposing a new add-on payment for dialysis equipment and supplies that are novel and demonstrate substantial clinical improvement (as with the new-technology add-on payments under the inpatient prospective payment system). This payment adjustment would be equivalent to 65 percent of the fee established by the DME Medicare Administrative Contractors (MACs), and would be paid for two years, after which time it would instead qualify as an outlier service.

CMS currently makes add-on payments for new renal dialysis drugs and biological products which may not yet be fully integrated into the pricing for an ESRD service category. For 2020, CMS proposes to exclude drugs submitted under an abbreviated drug application or under various types of new drug applications that may indicate a similarity to existing drugs.

For calcimimetics, CMS proposes to continue payment for a third year, but to reduce the add-on payment from the average sales price (ASP) plus six percent to ASP alone. This will match the new rate, effective 2020, for all new TDAPA drugs, of 100 percent of ASP. CMS also proposes to eliminate the erythropoiesis-stimulating agent (ESA) monitoring policy (EMP), as these agents are now incorporated into the per treatment payment amount.

Clarified standards for gap-filling new DME pricing

When new durable medical equipment is covered under Medicare, CMS often engages in a process known as “gap-filling,” in which it sets prices based on outside data sources on similar and identical technology and compiles these into a Medicare fee schedule. In years past, CMS has received significant criticism for the lack of transparency in the gap-filling process, including how it determines which technology is similar and what pricing data it uses.

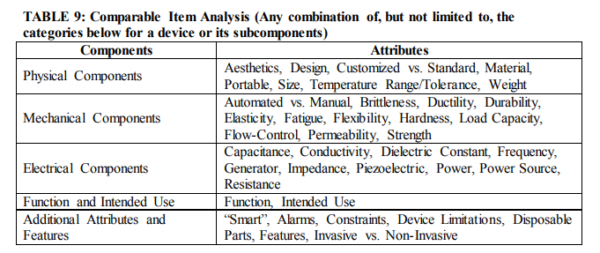

In this rule, CMS includes a list of proposed criteria by which it may determine that items are comparable for pricing purposes.

In addition, CMS proposes that it will use commercial and supplier price lists and technology assessments (including relative pricing to existing technology) to determine pricing for new DME only if comparable devices do not exist. CMS expresses concern in the proposed rule about the accuracy of price lists, and seems to prefer the use of technology assessments.

Pricing adjustments Proposed for rapid downward changes in costs

Generally, CMS does not adjust DME fee schedules once set, except for annual inflation increases, even if prices change or new products enter a category. However, CMS does express concern that, for new categories of DME where there are few or only one manufacturers or suppliers, initial prices may not yet reflect a competitive marketplace.

Therefore, CMS proposes in cases where supplier or manufacturer list prices are used to gap-fill DME fees, and when the market price decreases substantially within five years, CMS should re-gap-fill the prices to reflect the new market realities. This decrease would have to be at least 15 percent in order to trigger this repeat gap-filling, and would be a one-time adjustment. No repricing would be needed in the event of higher pricing, as CMS thinks that this would be accounted for via its annual updates.

Creating a master list of DME subject to heightened scrutiny

CMS has a variety of overlapping requirements for DME suppliers in order to curb suspected erroneous claim submission. These include required face-t0-face examinations, written orders prior to delivery, and prior authorization. The rule proposes a number of conforming amendments to the DME regulations in order to streamline these various requirements, but also proposes a master list of all items which meet the criteria for these utilization controls. This would consolidate three existing lists into a single “Master List of DMEPOS Items Potentially Subject to Face-To-Face Encounter and Written Order Prior to Delivery and/or Prior Authorization Requirements.” Based on the criteria in this rule, 413 items may now be chosen for prior authorization or other requirements. This list would be updated annually.

The rule also proposes a “totality of the medical record” standard for written orders prior to delivery, rather than the current, stricter requirements.

CMS Seeks Data to Reinstate National Diabetic Testing Supply Competition

CMS proposes a variety of technical changes to competitive bidding as concerns changes in ownership as well as parent-subsidiary relationships. While CMS has not reinstated competitive bidding for the national mail order program for blood glucose test strips, it is requesting comments on data sources that fulfill the statutory mandate that CMS consider multiple sources of data for test strip sales volumes in order to evaluate bidders in a future competition.